In about 10 days, if nothing happens, the US debt ceiling will not be raised and the government will start defaulting on it's debts. The details and specifics of this are unimportant, and most unexplainable. Bottom line: we've never done this before so there's really not a whole lot of certainty what will happen. Suffice to say, if today was any indicator, the stock markets are going to be running more and more scared. Because of the unknown.

I've often said that you have to suspend logic when thinking about the stock market. Whether we raise the debt ceiling or not, companies like, for example, Apple or Amazon, will continue to make just as many iPhones and sell just as many widgets the day after we default as they do the day before. They won't report any good or bad earnings, or introduce any new products or services. But conventional wisdom says their stocks, along with many other companies, will probably get hammered. Why? Because people won't know what will happen when the debt ceiling doesn't get raised. And when people don't know what to do, they sell. And when people sell, the computer programs sell. Everybody sells. And when everybody sells, prices drop.

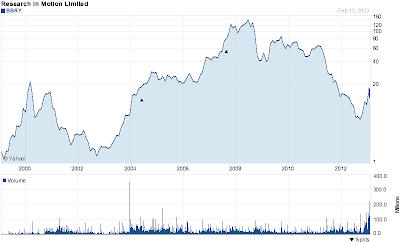

I'm no certified financial advisor, this is just my personal opinion and you may take it with the biggest of grains of salt. But in my opinion, now is not the time to stay in the market. Over the next 10 days or so, a few things can happen with the markets: 1) the debt crisis problem gets solved and the markets continue smoothly, 2) the debt crisis gets worse and the markets crash. I know what that means, the $50 stock I own today might be worth $20 in 10 days. In 2007 I was lucky enough to get out of the markets about 6 months before the crash. I was able to buy a lot of stocks for very low prices and they have since rebounded. I see the same thing happening in the next 2 weeks and I'm going to sit back and watch. I hope I'm wrong.